Nexus Compliance with State, Local, and County Tax Laws

In Part 1 we covered why you should want TaxJar, how the ZBrains CPQ tool integrates with TaxJar, and who TaxJar is for. Join us as we move towards a greater understanding of TaxJar:

When it comes to calculating your taxes and taking advantage of the joys of using TaxJar, tax nexus is vital. Determining nexus is an important element of tax compliance, and how you establish nexus can vary from state to state. Most definitions of nexus include the terms “doing business” or “engaged in business.” This blog details all the specifics regarding the various state laws.

The significant questions to ask yourself are:

- Do I have a location, warehouse, or other physical presence in a state?

- Do I have an employee, contractor, sales person, installer, or someone else working for me in a state?

- Do I have products stored in a state?

- Do my sales or number of transactions in a state exceed that state’s economic nexus threshold?

- Do I have a drop shipping relationship with a vendor in a state?

- Do I have an affiliate program with affiliates in various states?

- Do I cross state lines to sell my products at a trade show, craft fair, or other event?

Of note are the most common items that may not be taxable in some states:

-Grocery food

-Clothing

-Certain books (textbooks, religious books, etc.)

-Prescription and nonprescription medicine

-Supplements

-Magazines and subscriptions

-Digital products (books, music, movies, etc.)

Other Noteworthy Tax Nexus Issues

Once nexus is established it is crucial to do these three things:

-Register for a sales tax permit in that state

-Charge sales tax to customers in that state (regardless of how you sold them a product, or from where that product was shipped)

-File sales tax returns in that state

Perhaps the most obvious hurdle is the variability among state laws. For example, if you do not use TaxJar and have nexus in multiple states, you are forced to research the laws for each state on your own. This process can be tedious, especially when considering state, local, and county tax differences. Given all of this, the TaxJar automation of sales tax computation is truly an invaluable resource.

*Sometimes an identical product may be taxable in one state and non-taxable in another. A product may also not be taxable at the state level, but still taxable at the local level. *

Drop Ship, Ship Direct, and Multiple Warehouses with TaxJar

There are a few important scenarios to address when it comes to tax compliance. Drop shipping occurs when you use a vendor to ship an item directly to a customer. For example: you sell phone cases through your website and use a third party printing company to print designs on the cases before they are shipped to the customer.

Three things happen in this process: the customer buys the item from you, you buy the item from the vendor, and the vendor ships it to the customer. If your vendor has nexus in your state they must charge you sales tax on that purchase, unless you issue a resale certificate! The resale certificate indicates that the item you bought is for resale. This is where it can be complicated: you may be required to charge sales tax to your customer, and concurrently your vendor may need to charge sales tax to you.

Conversely, when shipping directly to the customer, you simply have to determine the sales tax in the buyer’s ship-to address.

Last but not least is the multiple warehouses scenario, which dictates that you must charge sales tax to buyers living in every state where your inventory is warehoused. A great example where this law may be overlooked is when sellers put their products Amazon FBA (Fulfillment by Amazon). It is easy to forget that you need to charge sales tax for buyers living in each state that your goods are warehoused through Amazon FBA.

API and Customer Service

One beauty of TaxJar is the SmartCalcs Sales Tax service, which is very easy to utilize using modern restful APIs. Once integrated, it can easily determine if, when, and how much sales tax to collect. Collect the right tax amount every time you sell a product! It also makes sales tax reporting and filing easier for you or your merchants. The SmartCalcs Sales Tax service is clearly one of the best joys of using TaxJar.

The New Kid on the Block: Economic Nexus

As of June 21, 2018, a new law went into effect: Economic Nexus. This nexus law requires that sellers collect sales tax in a state because:

-They make a certain dollar amount of sales in that state (most common threshold is $100,000 per year)

-Have a certain number of sales transactions in that state (most common is 200 per year)

Approximately half of the states with a sales tax have economic nexus laws, and more states have announced they will soon also pass economic nexus laws or regulations.

The Shortcomings of TaxJar

Although this blog explores the joys of using TaxJar, we would be remiss if we did not mention any of the problems. Despite all of the areas in which it excels, there are some caveats. Most notable is that it is not very flexible. The good news is that within Zoho Creator, you can perform your tax reporting without going to TaxJar. From drag and drop reporting and ad hoc reports to all the transactions in Creator, the bottom line is that it is easier to use than TaxJar. Simply use TaxJar to acquire accurate percentages, and then store that data back in Zoho Creator to generate your own reports.

Whether you are trying to determine tax nexus or simplify your tax compliance process, TaxJar can get you there. Explore this handy software for yourself and ensure you calculate your taxes with accuracy.

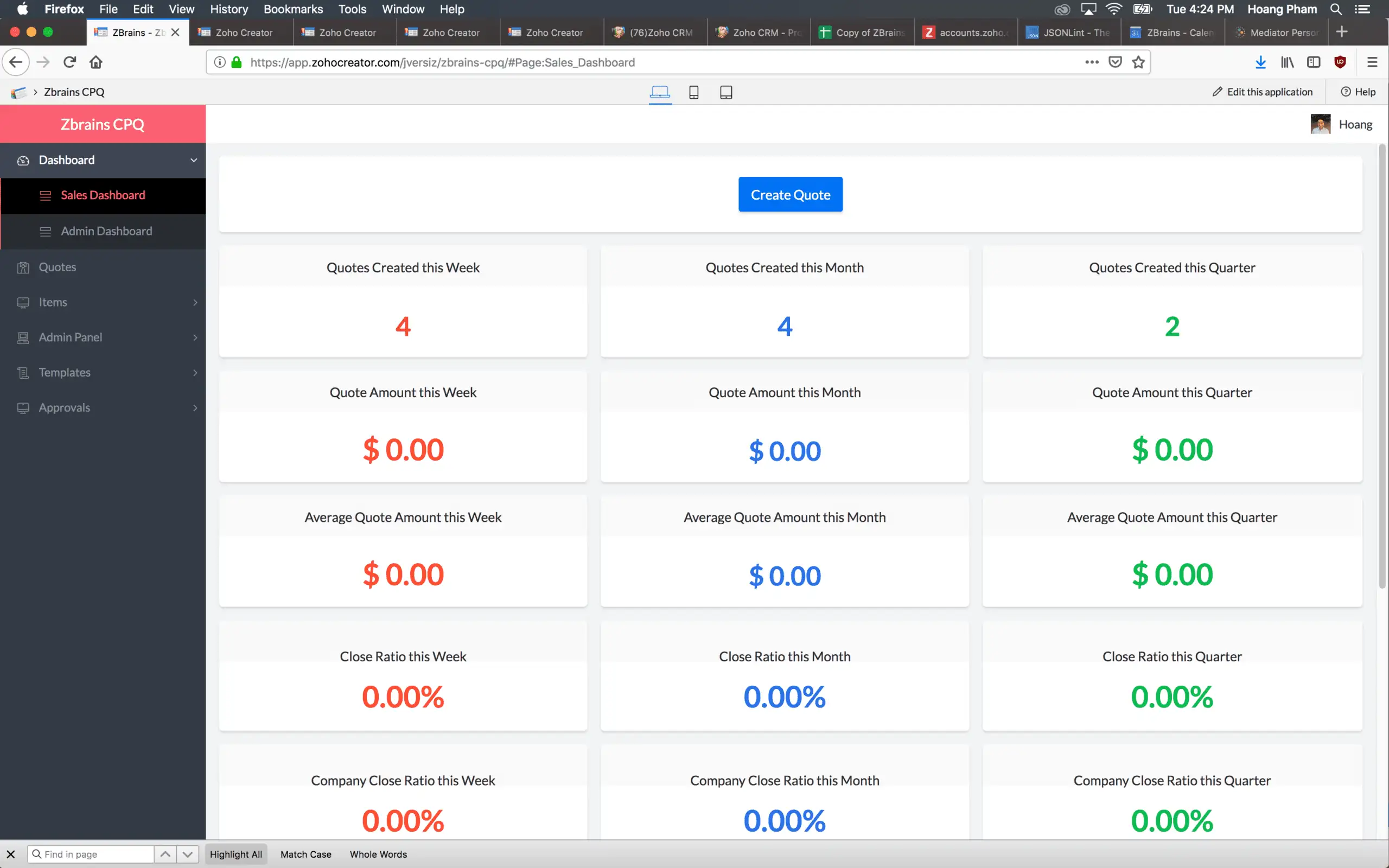

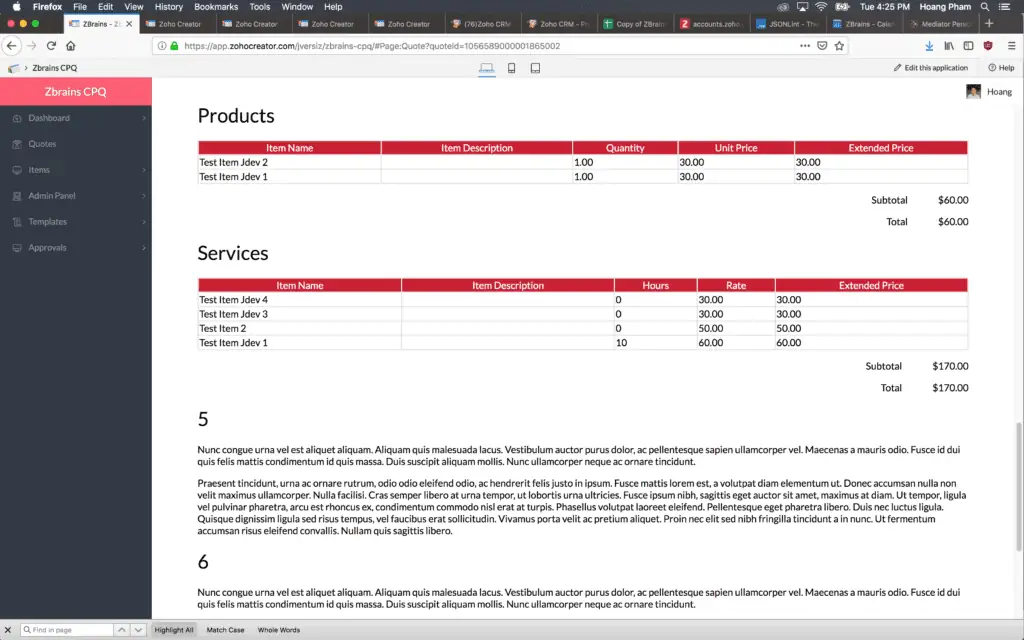

A great integration couples two parts of your business with ease, providing synergy that makes your job easier. Thus is the case with our Configure Price Quote (CPQ) and TaxJar. Generate sales quotes quickly and easily using our CPQ. The resulting process means you rely on just one system rather than an array of programs and personnel.

A great integration couples two parts of your business with ease, providing synergy that makes your job easier. Thus is the case with our Configure Price Quote (CPQ) and TaxJar. Generate sales quotes quickly and easily using our CPQ. The resulting process means you rely on just one system rather than an array of programs and personnel.