Comparing TaxJar and Avalara: Which One Fits Your Business Needs?

Determining the best Tax Software for your business is a crucial step in the evolution of any company. A good sales tax compliance software is a cinch to implement, easy to use, and ultimately solves your problems so you can get back to running your business. To compare TaxJar vs Avalara, we evaluated each SaaS (software as a service) on Ease of Use, Customer Support, Pricing, and Overall Customer Satisfaction. We hope this comparison article helps you make an informed decision about the best tax software for your business.

Ease of Use

Since the dawn of software solutions, people have put a premium on usability. What good is software if it takes months or even years to master the nuances? In terms of the customer/user experience, TaxJar is simply easier to use. TaxJar is built for multi-channel sellers, who can easily import data with a few clicks from Shopify and Amazon. By contrast, Avalara users are forced to download CSVs (comma-separated values) and re-format them to meet AvaTax requirements. In the end, you don’t have to take our word for it when it comes to the functionality of each SaaS, you can look at what customers are saying for yourself!

TaxJar Pros:

User-Friendly Interface: TaxJar offers an intuitive and easy-to-navigate platform, making it accessible to both accounting professionals and business owners with minimal tax knowledge.

Affordable Pricing Tiers: For smaller businesses, TaxJar’s pricing plans can be more budget-friendly compared to some other tax automation services.

Robust Reporting and Analytics: TaxJar provides detailed sales tax reports and analytics, enabling you to gain valuable insights into your business’s tax compliance performance.

TaxJar Cons:

Limited Integration: While TaxJar integrates with popular e-commerce platforms, it may lack integration options with certain lesser-known or industry-specific systems.

Customer Support Response Time: Some users have reported delays in getting timely customer support from TaxJar when facing issues or queries.

Avalara Pros:

Extensive Integration Options: Avalara offers a wide range of integrations with various accounting, e-commerce, and ERP systems, making it a versatile choice for businesses of all sizes and industries.

Global Tax Compliance: Avalara specializes in handling complex international tax regulations, which is beneficial for businesses with a global presence or those looking to expand globally.

Robust Tax Content: Avalara’s extensive tax database ensures accurate and up-to-date tax rates for thousands of jurisdictions, reducing the risk of errors in tax calculations.

Avalara Cons:

Higher Costs: Avalara’s comprehensive features and global capabilities come at a price, which might be more suitable for larger enterprises but could be a burden for smaller businesses.

Learning Curve: Due to its broad range of functionalities, it might take some time for users to fully grasp Avalara’s system and make the most of its capabilities.

When TaxJar is Right for You:

Choose TaxJar if:

- You operate a small to medium-sized business with a limited budget.

- Your sales tax needs are primarily focused on domestic transactions within the United States.

- You prioritize an easy-to-use platform with essential tax reporting features.

When Avalara is Right for You:

Choose Avalara if:

- Your business operates on a global scale, involving international transactions and complex tax regulations.

- You need a tax automation solution that integrates seamlessly with a wide array of existing business systems.

- The accuracy of tax calculations is crucial to your business, and you require access to a robust tax content database.

The Bottom Line:

Both TaxJar and Avalara offer unique strengths and cater to different business needs. Before making a decision, assess your business requirements, budget constraints, and long-term goals. While TaxJar can be a cost-effective and user-friendly choice for smaller businesses with simpler tax needs, Avalara’s extensive capabilities are better suited for enterprises operating on a global scale. Ultimately, the right choice between TaxJar and Avalara will depend on your business’s specific demands and growth aspirations.

Remember to review your tax automation solution regularly, as your business evolves, and tax regulations change. By staying informed and adapting your tax automation strategy accordingly, you can ensure seamless tax compliance and optimize your business’s financial processes.

TaxJar vs Avalara Pricing

When evaluating on price we considered the offer of a TaxJar free trial, the contract differences, and the extra fees charged by Avalara. A good first impression goes a long way, which is why TaxJar provides potential customers with a 30-day free trial. According to their website, this trial does not require a credit card. Plus, new customers to TaxJar do not face setup fees, cancellation fees, hidden fees, or forced annual contracts. From our research we found that annual contracts are the standard for Avalara customers: some being multi-year. Meanwhile, TaxJar proudly offers monthly plans because they stand behind their service rather than rely on contracts to keep customers around.

Last but not least are the fees built into each software. Our research indicates that a typical 20K transaction year with TaxJar will cost $2,150, a pittance compared to the $12,515 price tag for Avalara customers. The combination of an activation fee, annual connector fee, annual license, and monthly billing (among others) from Avalara contributes to this hefty final figure. All of this information illustrates why TaxJar is the more cost-efficient model.

Customer Support

Another pillar of great software is strong customer support, and unfortunately for Avalara customers, this is where they fall significantly short. The Avalara adage of ‘Tax compliance done right’ does not accurately reflect their customer support services. Time and time again customers have complained about the abysmal support from Avalara. The consensus among TaxJar customers is positive for their customer support. Calculating accurate taxes is important and the consequences can be more than a bit frustrating. As a result, TaxJar’s solid reputation of good customer support is so integral to the overall customer experience.

FAQs about TaxJar and Avalara

- Which businesses benefit most from TaxJar?

TaxJar is an excellent choice for small to medium-sized businesses that primarily operate within the United States. Its affordability, ease of use, and robust sales tax calculation capabilities make it a popular option among businesses with straightforward tax requirements.

- Is Avalara suitable for international businesses?

Yes, Avalara is highly recommended for businesses with international operations. Its global tax compliance features and support for various tax systems around the world make it an ideal choice for companies dealing with cross-border

- Can TaxJar handle complex tax scenarios?

While TaxJar is a reliable solution for most businesses, it may not be the best fit for those dealing with complex tax scenarios. If your business operates in multiple jurisdictions with intricate tax rules, Avalara’s advanced tax automation features and global tax compliance capabilities make it a more suitable option.

- Do TaxJar and Avalara integrate with popular e-commerce platforms?

Both TaxJar and Avalara offer integrations with popular e-commerce platforms, including Shopify, WooCommerce, Magento, and more. These integrations ensure seamless synchronization of sales data, making it easier to calculate and collect accurate sales tax information.

- Are there any additional fees apart from the base pricing?

Both TaxJar and Avalara may have additional fees based on factors such as transaction volume, additional features, and support options. It’s important to review each provider’s pricing structure carefully to understand any potential additional costs beyond the base subscription fee.

- Can TaxJar and Avalara handle sales tax exemption certificates?

Yes, both TaxJar and Avalara support sales tax exemption certificates. These certificates allow businesses to exempt specific transactions from sales tax based on valid reasons, such as resale or tax-exempt status. Both providers offer features to manage and validate exemption certificates efficiently.

Choosing the Right Solution for Your Business

When it comes to choosing between TaxJar and Avalara, it ultimately depends on your specific business needs and requirements. As an expert, can you write a short paragraph about Comparing TaxJar and Avalara: Which One Fits Your Business Needs? TaxJar is an excellent choice for small to medium-sized businesses operating primarily within the United States, thanks to its affordability and user-friendly interface. It provides reliable sales tax calculations, reporting, and integration options. On the other hand, Avalara shines when it comes to handling complex tax scenarios and catering to businesses with international operations. Its global tax compliance features, real-time tax calculations, and extensive integrations make it a comprehensive solution for companies dealing with cross-border transactions. Assess your business’s size, geographical reach, and tax complexity to determine which solution aligns better with your specific requirements.

Long-time users of TaxJar and brand-new customers alike can benefit from our Zoho Integration for TaxJar. Discover the benefits of this and all of our Zoho integrations!

Questions? Our Zoho Certified Consultants are ready to help.

Connect with a Consultant

Mobility:

Mobility:

Any comparison is incomplete without evaluating pricing differences and similarities. In this case, if we view the price of Zoho Books on its own, it clearly is more cost-effective. Zoho Books’ standard price is $20 per organization per month*, which includes 500 contacts, three users, and 10 automated workflows. Meanwhile, the “Essentials” package for QB Online is $40 per month, their equivalent of the Standard package. Therefore in this specific price comparison, Zoho Books has the edge.

Any comparison is incomplete without evaluating pricing differences and similarities. In this case, if we view the price of Zoho Books on its own, it clearly is more cost-effective. Zoho Books’ standard price is $20 per organization per month*, which includes 500 contacts, three users, and 10 automated workflows. Meanwhile, the “Essentials” package for QB Online is $40 per month, their equivalent of the Standard package. Therefore in this specific price comparison, Zoho Books has the edge.

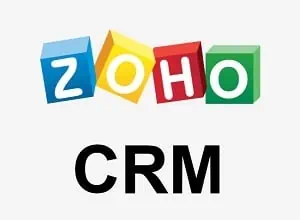

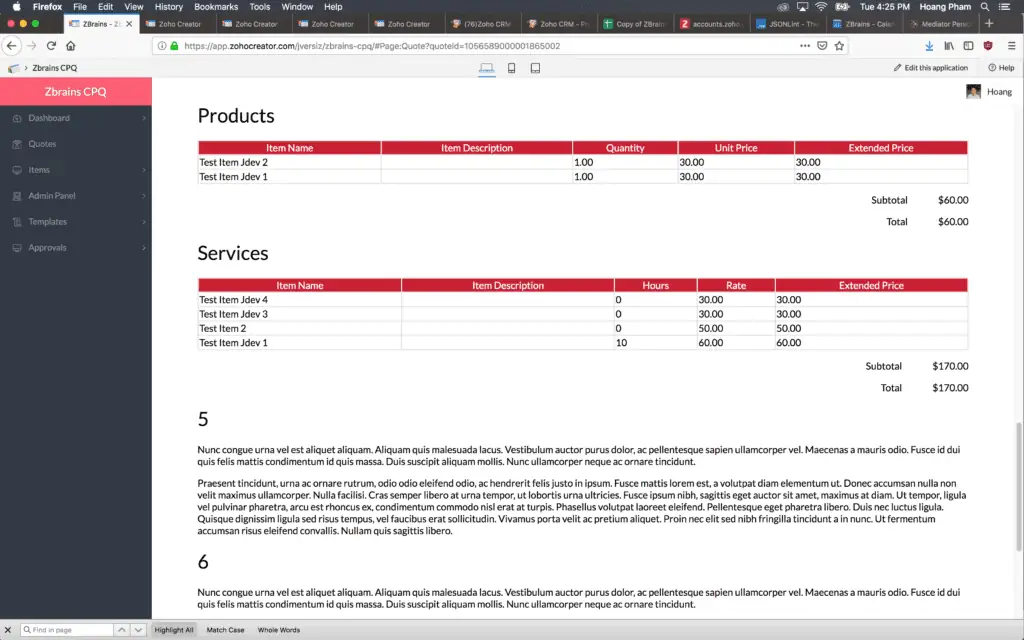

A great integration couples two parts of your business with ease, providing synergy that makes your job easier. Thus is the case with our Configure Price Quote (CPQ) and TaxJar. Generate sales quotes quickly and easily using our CPQ. The resulting process means you rely on just one system rather than an array of programs and personnel.

A great integration couples two parts of your business with ease, providing synergy that makes your job easier. Thus is the case with our Configure Price Quote (CPQ) and TaxJar. Generate sales quotes quickly and easily using our CPQ. The resulting process means you rely on just one system rather than an array of programs and personnel.