Zoho Books vs QuickBooks Online: Two Titans of Accounting Software

It’s true every tax season and usually the times in between, managing your finances has never been more important. But how do you tackle such a task? QuickBooks Online is used by more than 2.5 million companies, an impressive number. However, how many of those business owners are truly satisfied? How many are getting the most out of their accounting software? Zoho Books offers a few very useful features that QuickBooks lacks, especially when under the larger umbrella of Zoho Finance. Zoho Books vs QuickBooks Online is a veritable clash of titans, and both bring particulars to the table that appeal to wide audiences.

Our goal is to help you make a more informed decision about your accounting software. Whether you are buying for the first time, re-evaluating your current tools, or simply seeing what else is out there, we hope this comparison makes your job easier. Join us as we navigate the waters of financial software:

Comparing the Significant Features of Zoho Books vs QuickBooks Online

A great place to begin when comparing and contrasting these two is their nuts and bolts; in what they do best and offer to the customer. The three things that QuickBooks (QB) offers over its Zoho equivalent are:

- Payroll Processing

- Budget and Forecasting

- Online Bill Payments

Conversely, Zoho Books provides its own slate of unique features that do not exist in QB:

- Workflows: Create different workflows based on your needs

- Create Users: Add users to your organization for easy collaboration

- Client Portal: Not only allows for communication with customers in an interactive portal, but you can also send them sales orders once they accept your estimate! Plus, this feature allows you to collaborate with clients by sending messages through the portal.

The Sales Orders issue is incredibly crucial, because QuickBooks Online is severely lacking in this arena, which translates to an inventory tracking system that is not robust. In this sense, the “inventory tracking” feature boasted by QB Online is misleading, because the software simply offers no way to reserve inventory! This inability to create sales orders and therefore an inability to track orders placed by customers is a not-so-subtle blemish on the QuickBooks image/brand.

There are a few other noteworthy Zoho features worth mentioning:

- Integrates with multiple shipping options out of the box, including FedEx, UPS, and USPS

- Offers a useful multi-currency option for balance sheet accounts (assets, liability, equity)

- Zoho Books allows for use with 6-10 payment gateways

- Zoho Books includes a Retainer Invoice- affords you the ability to track prepayments

Unraveling the Perfect Fit: Zoho Books vs. QuickBooks Online

- User Interface: A Delightful Experience

Regarding the user interface, Zoho Books immediately stands out with its clean and intuitive design. Navigating various modules, such as invoices, expenses, and reports, becomes effortless, making it an ideal choice for accounting professionals and small business owners with limited financial expertise. On the other hand, QuickBooks Online boasts a feature-rich user interface that caters to the needs of more experienced accountants, offering advanced customization options and in-depth financial reports.

- Scalability: From Startups to Enterprises

Moving on to scalability, both Zoho Books and QuickBooks Online have been thoughtfully designed to cater to businesses of all sizes. Zoho Books takes a more budget-friendly approach for startups and small businesses, providing essential accounting functionalities without overwhelming users with unnecessary features. Conversely, QuickBooks Online has established itself as a reliable choice for larger enterprises, offering advanced inventory management, payroll processing, and a broader range of integrations.

-

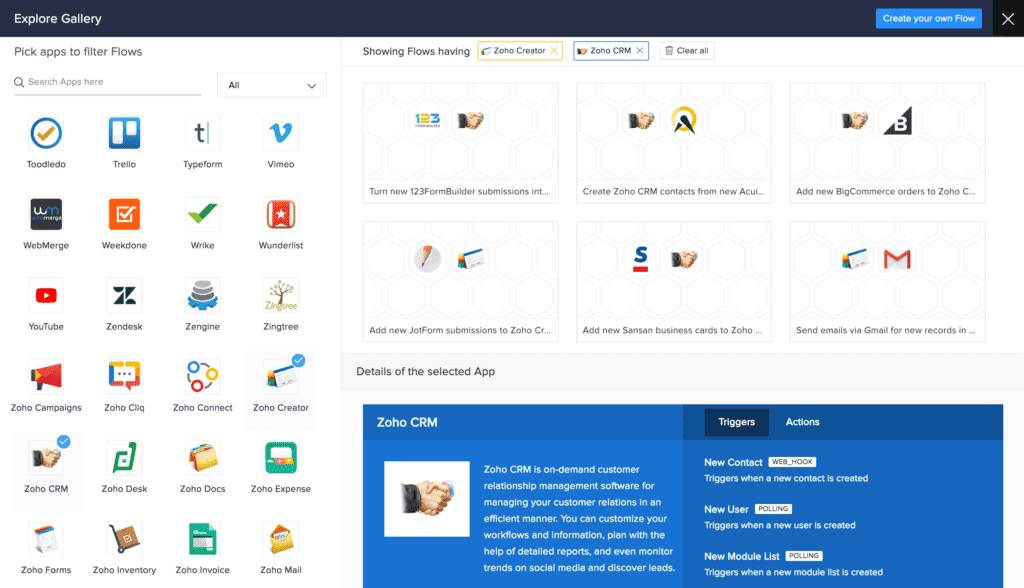

Integration Ecosystem: Building a Unified Workflow

In today’s tech-driven world, seamless integration between different business applications is essential for optimizing productivity. Zoho Books, part of the Zoho suite, boasts excellent integration capabilities with other Zoho apps, such as Zoho CRM and Zoho Inventory, providing a unified ecosystem for managing various aspects of your business. On the other hand, while having an extensive integration network, QuickBooks Online might require third-party integrations to achieve a similar level of consolidation.

- Automation and Time-Saving Features

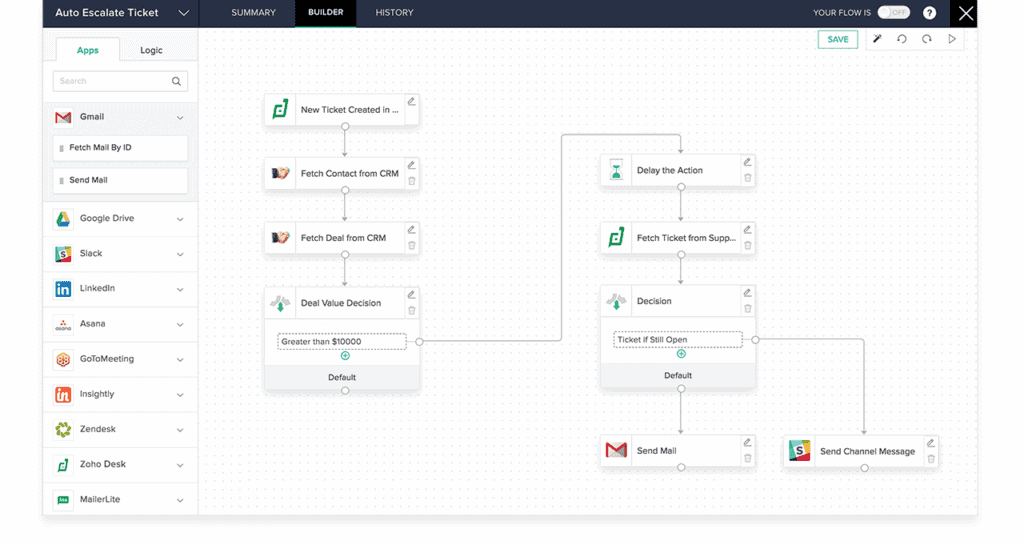

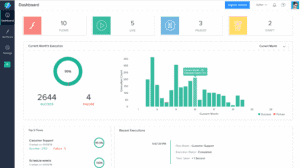

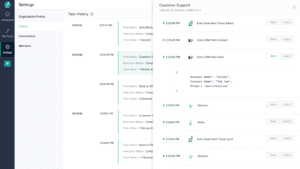

In the race to minimize manual efforts, Zoho Books and QuickBooks Online offer automation features that streamline repetitive tasks. Zoho Books stands out with its intelligent workflows, automating invoice reminders, payment notifications, and bank feeds. Similarly, QuickBooks Online is known for its robust automation capabilities, simplifying tasks like recurring invoices, expense tracking, and automatic backups.

-

Mobile Accessibility: Managing Finances on the Go

Considering the importance of mobile accessibility, business owners are constantly on the move, and having access to financial data at their fingertips is crucial. Zoho Books and QuickBooks Online offer mobile apps that allow users to manage finances, capture expenses, and send invoices from their smartphones or tablets. However, the Zoho Books app excels in user-friendliness and speed, providing a hassle-free experience for on-the-go accounting.

Price Comparison of Zoho Books vs QuickBooks Online

However, if you crave the full accounting power from Zoho (which includes a fleet of applications: Invoice, Books, Zoho Inventory, Subscriptions, Expense, Checkout), you will need Zoho Finance. Operating with the integrated capabilities of Zoho Finance Plus does require a more substantial investment, to the tune of $249 per month for 10 users*. This price includes 10 users and a slew of other fantastic features, all of which you can explore here. *Pricing updated June 2021

+ An important note about pricing: QB charges additional fees for data migration, Zoho Books does not.

Overall Comparison

Ultimately, one of the most difficult hurdles for users of QuickBooks is to even consider a switch to another software. Fans of QuickBooks often believe that a transition to another operating platform will be too much of a hassle (if it ain’t broke, don’t fix it!). But the truth is that Zoho Books has more than its fair share of advantages over QB Online, and the integrations with other Zoho software make it that much more valuable.

Plus, a nifty bonus of Zoho Books is that the mobile features can be accessed on phones from Apple, Android, and Microsoft, as well as Kindles (QB can only handle Apple + Android).

In the end, Zoho Books offers a reliable way to completely migrate off QuickBooks. Not completely sold? Check out our Zoho QuickBooks Online integration, which allows you to continue to use QuickBooks Online and share that data with the Zoho CRM. Our team of Zoho consultants can tell you the best way to set it up based on how you conduct business.

Conclusion

There’s no one-size-fits-all answer in the ultimate showdown between Zoho Books and QuickBooks Online. Each platform has unique strengths, catering to different business sizes and needs. Zoho Books is a top contender for small businesses and startups seeking a budget-friendly, intuitive, and seamlessly integrated solution. On the other hand, QuickBooks Online appeals to larger enterprises, offering advanced features and an extensive integration ecosystem.

Before making your choice, it’s essential to consider the specific requirements of your business, the level of accounting expertise available, and your long-term scalability needs. Ultimately, whether you opt for Zoho Books or QuickBooks Online, you will find a powerful accounting tool that streamlines your financial management and empowers your business to thrive. Happy accounting!

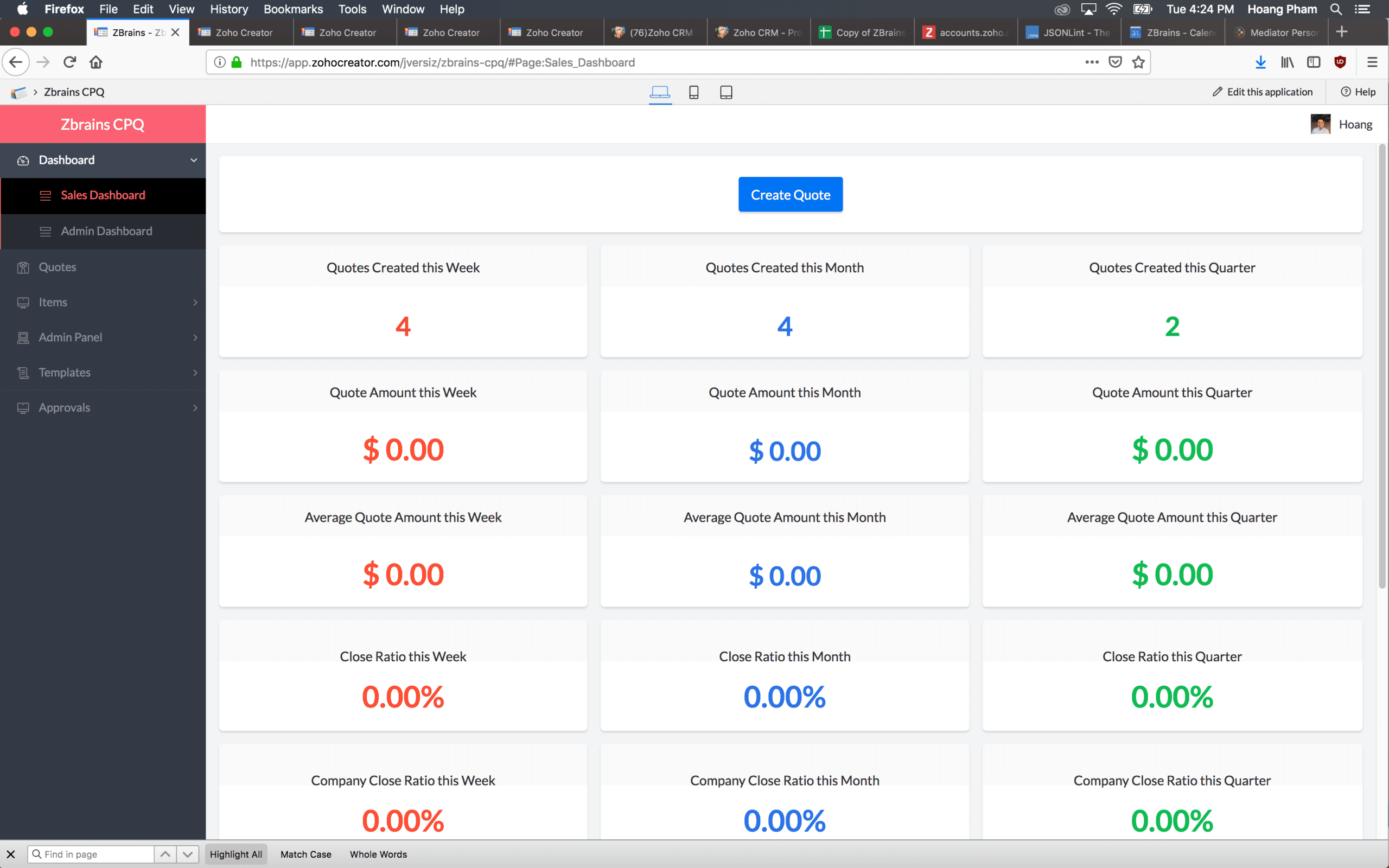

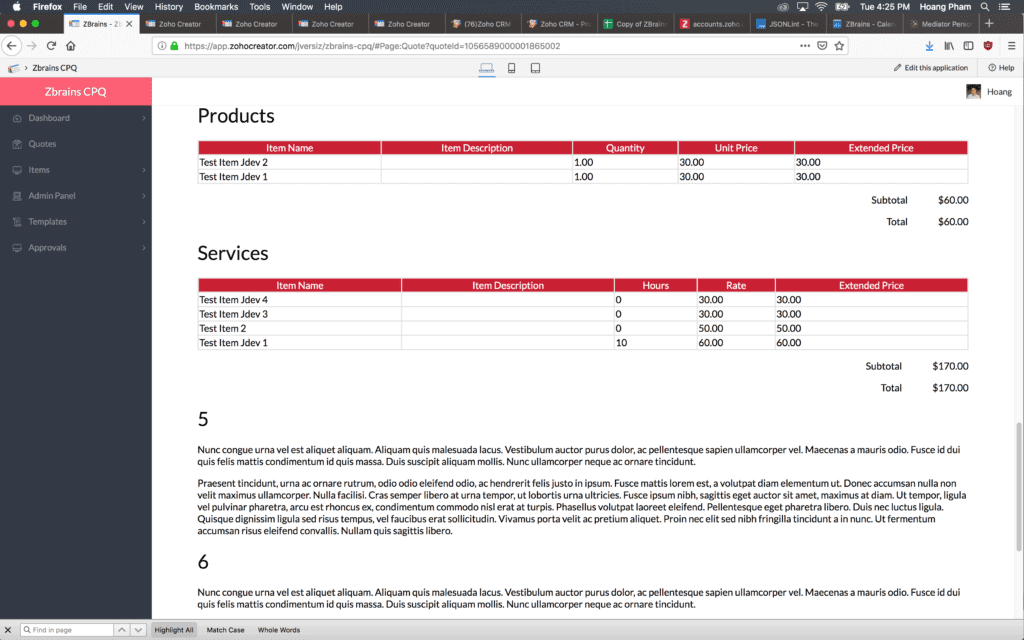

A great integration couples two parts of your business with ease, providing synergy that makes your job easier. Thus is the case with our Configure Price Quote (CPQ) and TaxJar. Generate sales quotes quickly and easily using our CPQ. The resulting process means you rely on just one system rather than an array of programs and personnel.

A great integration couples two parts of your business with ease, providing synergy that makes your job easier. Thus is the case with our Configure Price Quote (CPQ) and TaxJar. Generate sales quotes quickly and easily using our CPQ. The resulting process means you rely on just one system rather than an array of programs and personnel.